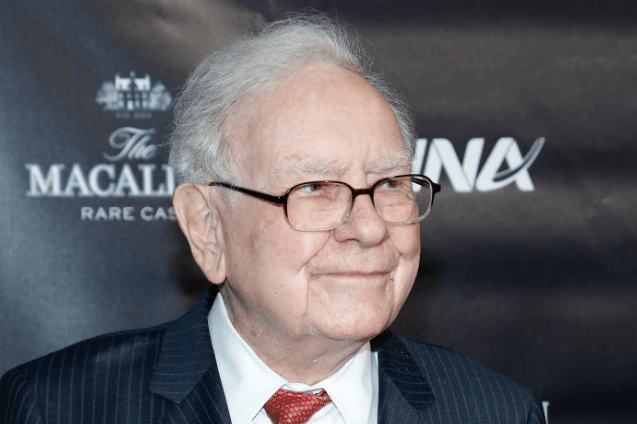

The Rise of Berkshire Hathaway: How Warren Buffett Acquired 20% Stake in American Express

American Express (AmEx), a leading credit card company, has been a favorite of Berkshire Hathaway CEO Warren Buffett for many years. In December, Buffett stated, “You can’t create another American Express. I could create another shoe store, another business publication, but I can’t replicate the perception people have of American Express.” As of September 29, 2022, Berkshire held 20.29% of AmEx shares, valued at $26.1 billion, making it one of the company’s largest shareholders.

Berkshire Hathaway’s investment in AmEx is a testament to the company’s significance and reputation. American Express CEO Stephen Squeri said that having Berkshire as a shareholder is like a “Good Housekeeping seal of approval.”

The pandemic had a major impact on AmEx in 2020, causing its stock to drop to $66 as lockdowns and travel bans impacted profits by 39%. Despite the challenges, Buffett kept his stake in the company and AmEx was able to recover, reaching its highest price in decades at $196 a share in 2022. The company’s latest quarterly results showed a slight miss for Q4, but the outlook for the rest of the year remains positive.

Buffett’s interest in AmEx dates back to the 1960s, during the first wave of consumer credit via banks. The company was involved in the “salad-oil scandal” in 1963, which raised concerns on Wall Street. Despite the rough start, Berkshire’s stake in AmEx gradually increased from 11.2% in 1998 to 20% in 2022.

One of AmEx’s greatest assets is its status symbol perception, which has been maintained through rebranding efforts. The company generates revenue from interest and fees from cardholders and merchants, who are charged more than competitors like Visa or Mastercard because AmEx cardholders tend to be wealthier. AmEx also collects data on cardholder spending for targeted marketing and offers.

In recent years, AmEx has evolved from a luxury credit card provider to a digital payment provider, attracting millennial and Gen Z consumers. The company rebranded its Platinum card as a “lifestyle card,” increased its fees and at-home perks, and entered e-commerce and food delivery services, doubling its Platinum cardholder count. The company also expanded its global reach with new travel benefits and a Centurion airport lounge.

The pandemic prompted AmEx to revamp its strategy, focusing on digital payment methods and increasing rewards. The company’s payment method is now accepted in over 178 countries, making it a global leader in digital payments. AmEx’s efforts have paid off, as the company has captured the interest of millennial and Gen Z consumers, who make up 60% of new consumer cardholder growth.

In conclusion, AmEx’s significance to Berkshire Hathaway is clear, with Buffett stating, “It’s a wonderful thing if you’ve got an asset you like and they take your ownership interest up.” AmEx’s rebranding efforts and focus on digital payment methods have helped the company endure the pandemic and continue to grow, solidifying its position as a leading credit card company.

About American Express:

American Express, commonly known as AmEx, is a multinational financial services corporation that was founded in 1850. It is best known for its credit card services, but it also offers a wide range of other financial products and services, including travel services, insurance, and loans. AmEx is headquartered in New York City and operates in over 130 countries worldwide. The company is known for its premium brand image and its exclusive card offerings, such as the Platinum Card and the Centurion Card. AmEx has a reputation for providing high-quality customer service and a wide range of rewards and benefits for its cardholders. In recent years, the company has focused on expanding its digital payment services and has become a popular choice among millennials and Gen Z consumers.

Keywords: American Express, credit card, company, Warren Buffett, Berkshire Hathaway, CEO, perception, shareholder, Stephen Squeri, pandemic, stock, lockdowns, travel bans, profits, interest, fees, cardholders, merchants, Visa, Mastercard, wealthier, data, marketing, digital payment, millennial, Gen Z, rebranding, global reach